One perfectly normal day, I was sitting next to my partner, watching him purchase some items on Amazon. I nearly spit out my apple juice as he went to the payment page and clicked “Use Points.”

“NOOOOOOOOOOOOOOOOO!” I screamed as he clicked “Pay Now.”

I tried to explain to my incredibly stubborn male partner that you can get SO much more value out of your miles/points by using them for travel to which he responded, “I don’t understand, I always use my points for Amazon because the option shows up here.”

I made him promise me he wouldn’t do it again. And I promised that I would teach him how to use the points correctly. It may have taken me 2 years, but he now finally understands what to do. So I now feel it’s time to break it down for you! Don’t worry, I bet you will pick it up quicker than him…

Breaking Down Points & Value

The point of this blog is to encourage you to actually figure out the best value for your miles and credit card points. It’s far more lucrative to use them for flights or hotels with your credit card travel portal (or by transferring them to an airline) than it is to use them to pay for your already planned purchases. This goes for statement credits, merchandise purchases, or essentially paying with points in any scenario. For the sake of clarity, please know that miles and points will be used interchangeably and mean the same thing in this blog. I’ll be using examples from 2 of my favorite credit cards, both of which are linked here: Capital One Venture X and Bilt Mastercard.

1:1 Value

The simplest way to understand the point system (because I know…we didn’t learn this in school) is by 1:1 ratio. I’ll use some real examples because I’m not a math guy. This will hopefully help, especially if like me you are a visual and experiential learner. A 1:1 points to $ ratio would be as follows: 1 point= .01 cents, 10 points= .10, 100pts= $1.00, 1000pts= $10.00, 10,000pts= $100.00 (kinda get it?)

REAL EXAMPLES

Amazon Capital One Conversion: (don’t do it)

Amazon: Capital One Miles

A LOT of credit cards now let you use points for Amazon purchases. It’s a ruse! They’re trying to get you to waste your points! My conversion rate is likely the same as yours (pictured first). It is 125: $1.00 (more than 100:$1.00)

So for 3,125 miles, you’d get a $25 gift card for Amazon. If the miles were 1:1, you’d be using 2,500 miles for a $25 gift card. See? You’d be wasting 625 miles which is $6.25. Not THAT much you may be saying. But it all adds up.

Cash Redemption Example (don’t do it)

As you can see in this image, 3,549 points would get you $17.75 in cash. Remember, that point value should be worth AT LEAST $35.49 if you’re redeeming it for it’s 1:1 value. So you’ve just wasted nearly half of the value by redeeming it for cash.

Covering Purchases (do it if you have to)

Here you see that you can redeem your miles to cover purchases you’ve already made at a 1:1 ratio. This isn’t a bad idea, but it’s still not the best you can do! To be fair, it may be the best you can do on Capital One.

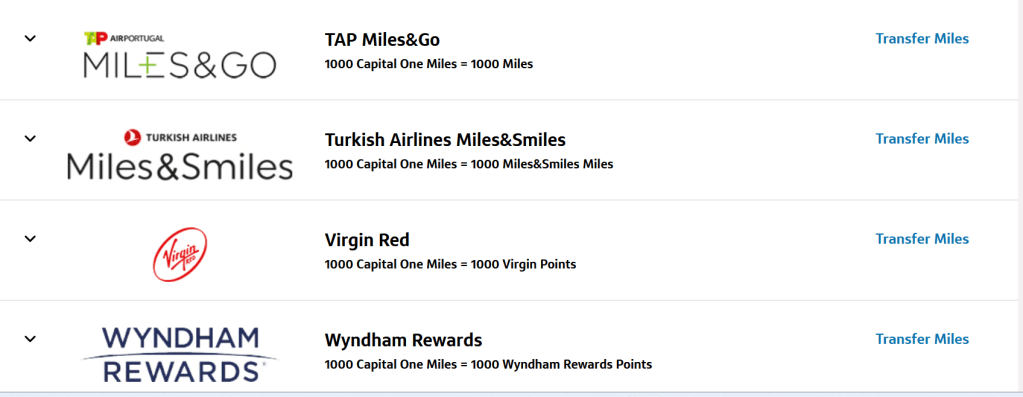

Transferring Miles (do it if it’s logical!)

If you belong to another partner, such as a specific airline or hotel chain, I recommend looking up the transfer rates from your credit card to those partners. These (pictured above) all have 1:1 transfer, which is good. Sometimes your points will be worth more in those other various homes, so be sure to consider that. For example, say you’re looking at flights on Virgin Air and find a $400 round trip ticket. Check the cost if you were to use points. If the point value is something less than 40,000, it’s a good time to transfer your points and use them to book that flight.

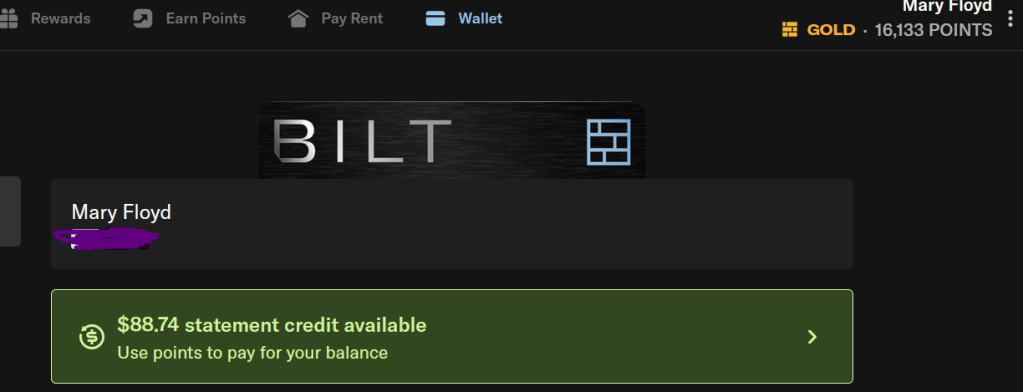

Statement Credits (don’t do it)

Obviously, this is a shift in credit card examples. With my Bilt account I can use my points to pay off my statement credit. That would be a TERRIBLE idea if I want to utilize these magnificent points. Pictured above, I have 16,133 points, and by the 1:1 standard that’s worth $161.33. This green box is offering me $88.74 off my statement credit to waste all my points. That’s basically HALF their basic value. Don’t do it.

Bilt Transfers

Pro Tip: Bilt offers a way to check your point transfer options on their app. This is only for one-way reward tickets through all 12 of their partners. It’s unlike any other credit card travel portal, and I love it. In case it’s confusing, here’s an example. I have points with Bilt, and I’m looking for an LAX-NYC flight next week. Bilt’s transfer search engine tells me I can fly: United for 10K points, Virgin Air for 15k points, or Delta for 9k points. What one would you choose? Then I can transfer my points to Delta to book the flight, etc.

It’s an incredibly useful tool. I recommend Bilt, the Bilt credit card (especially if you pay rent), AND their travel portal. Find my referral here.

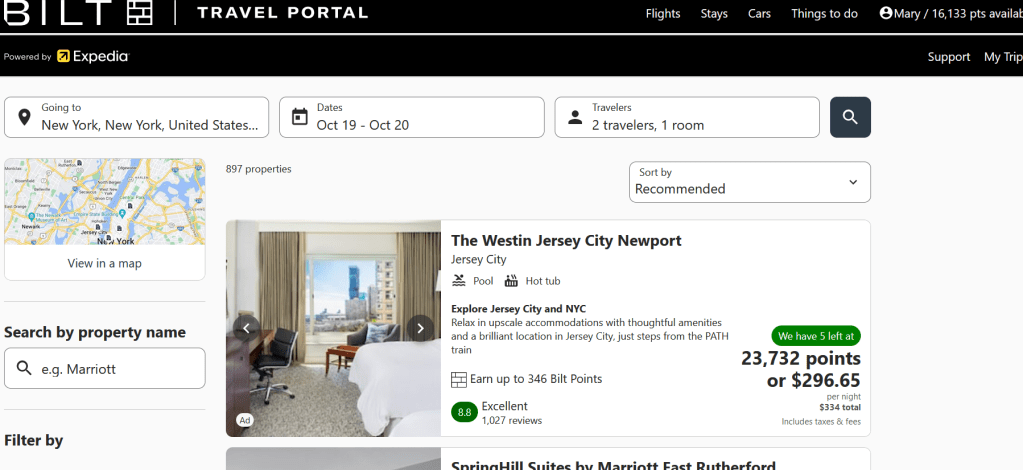

Check Multiple Sites (if you have multiple cards)

Below are examples of the Bilt travel portal vs the Capital One travel portal for the same hotel on the same night, checked at the same time.

Pop Quiz! Which one would you book?

Answer: the one with the cheaper miles! Capital One is offering a 1:1 ratio here (32,511 miles for $325). Bilt is offering a better deal: 23,732 points for $296.65. Comparing is helpful even if you don’t have the points because the Bilt option is also cheaper with money. However, it’s EVEN cheaper when using points because they give you a better value. A 1:1 would be 29,665 points for $296.65. So you’re saving 5,933 miles. That’s $59.33!

Is it starting to make sense? I know it can be confusing. For me, it has literally taken years, a calculator, and lots of trial and error.

In Conclusion

Points are confusing, but I’m here to help you! When in doubt, put a decimal in the tenths spot and call it money. If you’re not getting that value of money, it is not worth it! In my experience, the most optimal way to use your miles is by booking flights, hotels, and rental cars through your credit card travel portal OR by transferring your credit card points to airline or hotel partners. Hopefully I caught you in time to prevent the Black Friday point wasting!

Want more travel advice? Find me on social medias @goawayalextravel or join my email list for the latest blogs!

Leave a comment